Estimating profit margins is a crucial step for any business, especially for those involved in the sale of consumer goods like umbrellas. Whether you’re an umbrella manufacturer, wholesaler, or retailer, understanding your profit margins can help you make informed pricing decisions, assess the financial health of your business, and ensure that you’re operating efficiently. Estimating profit margins involves analyzing both the cost structure of your product and the revenue you generate from its sale. In this article, we’ll explore how to estimate profit margins for umbrella sales and highlight key factors that influence these margins.

Profit Margins in Umbrella Sales

Profit margin is a financial metric used to assess the profitability of a business or product. It is expressed as a percentage, showing how much of the revenue from sales is retained as profit after accounting for all expenses. There are two primary types of profit margins that are most relevant to umbrella sales: gross profit margin and net profit margin.

Gross Profit Margin

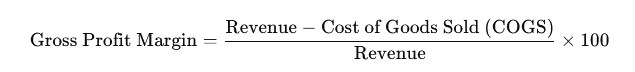

Gross profit margin measures the difference between the cost of goods sold (COGS) and the revenue generated from sales, excluding other operational expenses. For umbrella sales, gross profit margin is a good indicator of how efficiently you are producing or sourcing your umbrellas.

Formula:

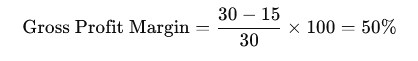

For example, if you sell an umbrella for $30 and your COGS is $15, your gross profit margin is calculated as follows:

A gross profit margin of 50% means that half of the revenue generated from each umbrella sale is profit after accounting for production or acquisition costs.

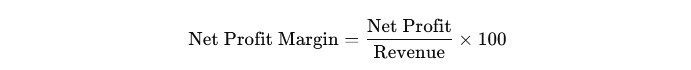

Net Profit Margin

Net profit margin, on the other hand, takes into account all other operating expenses, including marketing, rent, salaries, utilities, and taxes. This margin is more comprehensive and reflects the overall profitability of your business.

Formula:

Net profit margin is often lower than gross profit margin because it includes fixed and variable costs that aren’t directly tied to the production of the product but are essential for running the business.

Factors Influencing Umbrella Profit Margins

Estimating profit margins for umbrellas requires understanding the various factors that impact both costs and revenues. The key factors influencing profit margins in umbrella sales include production costs, pricing strategy, market demand, distribution channels, and overhead expenses.

Production and Sourcing Costs

The primary driver of your profit margin in umbrella sales is the cost of goods sold (COGS). This includes all the costs directly associated with the production or acquisition of umbrellas. There are several elements to consider here:

- Raw Materials: The materials used to make the umbrella—such as the fabric for the canopy, metal for the ribs and shaft, and plastic or wood for the handle—determine a large part of the cost. Higher-quality materials, like UV-resistant fabrics or windproof frames, may increase the cost of production.

- Manufacturing Costs: The process of producing umbrellas involves labor costs, machinery, and factory overhead. If you’re manufacturing your own umbrellas, you’ll need to account for the cost of skilled labor, factory maintenance, and other related expenses.

- Sourcing and Import Costs: For businesses that source umbrellas from third-party manufacturers or overseas suppliers, the cost of importing goods, tariffs, and shipping must also be factored into COGS. Additionally, if you’re purchasing umbrellas in bulk, you may be able to negotiate discounts, reducing per-unit costs.

Pricing Strategy

The price at which you sell your umbrellas has a direct impact on your profit margin. There are several approaches to pricing that can influence your margin:

- Cost-Plus Pricing: This method involves adding a fixed markup to your cost of goods sold to determine the selling price. For example, if an umbrella costs $10 to produce and you add a 100% markup, the retail price would be $20. This method ensures that you cover your costs and make a profit, but it’s important to strike the right balance between profitability and market competitiveness.

- Value-Based Pricing: This approach sets prices based on the perceived value of the umbrella rather than its cost. For example, if your umbrella has unique features such as being windproof or offering UV protection, you may be able to charge a premium price. Value-based pricing often results in higher profit margins but requires a strong brand and product differentiation.

- Competitive Pricing: In a highly competitive market, pricing may be dictated by what your competitors charge for similar products. If you price too high, you risk losing customers to other brands; if you price too low, you may struggle to cover costs and maintain profitability. Understanding the competitive landscape is crucial for estimating a profitable margin.

Market Demand and Consumer Preferences

Market demand plays a significant role in determining your profit margins. If there is high demand for umbrellas, especially for specific styles, colors, or features (such as windproof or UV-blocking), you may be able to set higher prices, thereby increasing your margin.

Consumer preferences, too, are vital. If consumers are willing to pay more for fashionable, durable, or multifunctional umbrellas, you can adjust your pricing strategy to reflect these preferences. Umbrella designs that cater to specific needs, such as automatic open/close mechanisms or travel-friendly compact designs, may justify a higher price point and result in a higher margin.

Distribution Channels

The way your umbrellas are distributed will also affect profit margins. Whether you’re selling directly to consumers, through retailers, or via e-commerce platforms, the distribution model impacts both your cost structure and the final price.

- Direct-to-Consumer (D2C): Selling directly to consumers, either online or through your own physical store, can result in higher profit margins because you eliminate middlemen and their associated costs. However, this approach requires significant marketing efforts and infrastructure to handle logistics, customer service, and returns.

- Retailers and Wholesalers: Selling to wholesalers or retailers typically results in lower profit margins because they take a cut of the sales price. However, this model can drive higher sales volume and provide access to established markets, which can make up for the reduced margin through increased turnover.

- E-commerce Platforms: Selling through online platforms like Amazon, eBay, or Etsy can offer broader reach, but these platforms typically charge fees and commissions that reduce profit margins. Additionally, there may be shipping and fulfillment costs to consider, especially if you’re offering free shipping to customers.

Overhead Costs

Overhead costs, which are not directly tied to the production of the umbrellas but are necessary for running the business, must also be taken into account when estimating profit margins. These can include:

- Marketing and Advertising: If you’re investing in digital marketing, influencer partnerships, or print advertisements, these costs must be factored into your pricing strategy to ensure you maintain a healthy profit margin.

- Warehousing and Shipping: For businesses that stock large quantities of umbrellas, warehousing and shipping costs can be significant. These expenses must be included in the overall cost structure to determine the profitability of your product.

- Labor and Administrative Costs: Salaries, office rent, and utilities all add to your operational expenses. These costs can significantly affect your bottom line, so it’s important to allocate them properly when calculating net profit margin.

Seasonal Variations in Umbrella Sales

Umbrella sales tend to be seasonal, with spikes in demand during rainy seasons or specific events such as festivals or concerts. Seasonal variations can significantly affect your profit margins.

- Off-Season Sales: During the off-season, when demand for umbrellas is lower, you may need to offer discounts or promotions to maintain sales. This can erode your profit margin, especially if you’re carrying excess inventory that needs to be sold.

- Peak Season Sales: Conversely, during peak seasons, such as the rainy season, you can often command higher prices due to increased demand. However, competition may also intensify, so strategic pricing and product differentiation become important factors in maintaining healthy margins.

Calculating Profit Margins for Umbrella Sales

Once you’ve identified the relevant factors affecting your umbrella sales, you can begin estimating your profit margins. Here’s a step-by-step process to calculate gross and net profit margins:

Step 1: Calculate Cost of Goods Sold (COGS)

Start by calculating the total cost of producing or acquiring each umbrella. This includes:

- Raw material costs (fabric, frame, handle, etc.)

- Manufacturing or sourcing costs

- Shipping and import costs (if applicable)

Let’s say the total COGS for one umbrella is $12.

Step 2: Determine the Selling Price

Next, you need to set the selling price for your umbrella. Suppose you plan to sell it for $30.

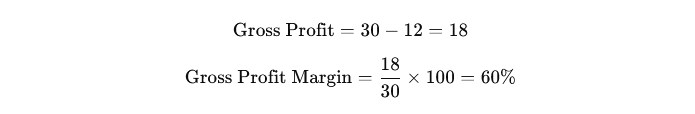

Step 3: Calculate Gross Profit Margin

Now, calculate the gross profit margin by subtracting the COGS from the selling price and dividing it by the selling price:

In this example, the gross profit margin is 60%, meaning you keep 60% of the revenue from each umbrella sale after covering the production costs.

Step 4: Calculate Net Profit Margin

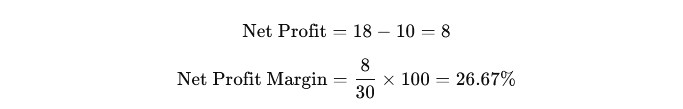

Next, you’ll need to account for all other operating expenses, such as marketing, labor, and overhead, to calculate the net profit margin. Suppose these costs total $10 per umbrella. The net profit is:

In this case, the net profit margin is 26.67%, which reflects the overall profitability after all expenses are accounted for.

Maximizing Profit Margins in Umbrella Sales

To increase your profit margins, focus on reducing costs, improving operational efficiency, and optimizing your pricing strategy. Strategies for boosting margins include:

- Negotiating better terms with suppliers to reduce raw material costs.

- Streamlining manufacturing processes to minimize waste and increase efficiency.

- Expanding into new markets to increase sales volume while maintaining competitive pricing.

- Offering premium umbrella models with higher profit margins to cater to niche markets.

By continuously evaluating and adjusting your cost structure and pricing strategy, you can ensure that your umbrella business remains profitable in a competitive marketplace.